Embedded lending to take your business further

Unlock new revenue potential while connecting your customers to the transparent and tailored financing options they need.

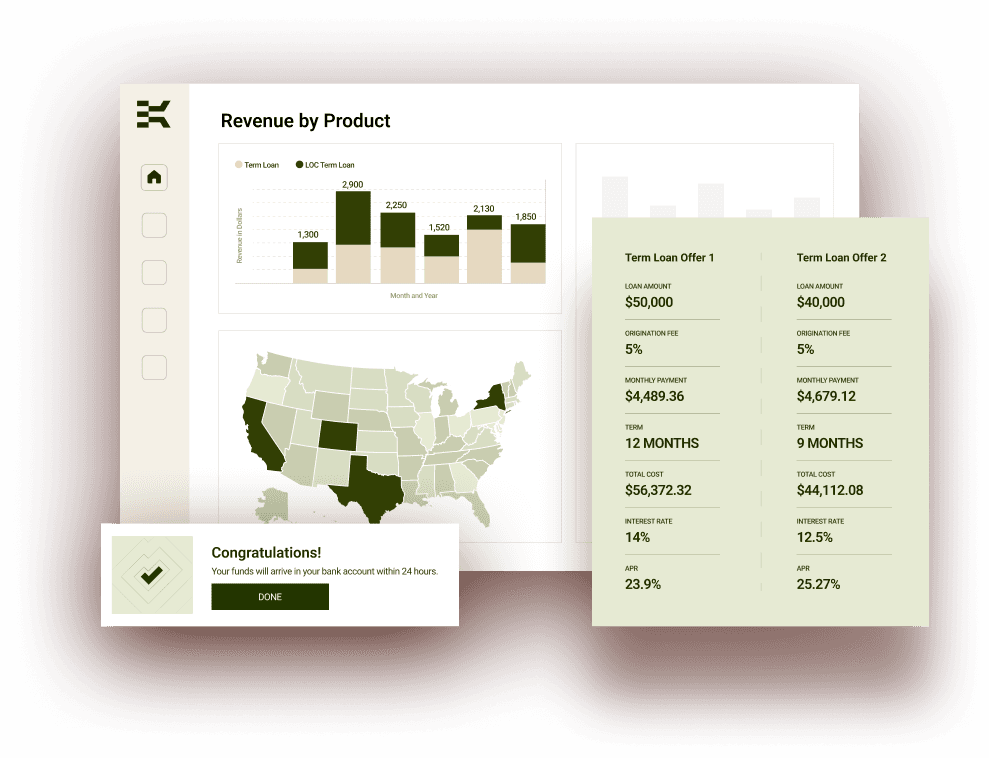

Kanmon enables practice management software platforms to offer term loans and lines of credit.

Access

to capital

Give your customers the funding they need without leaving the platform they know.

Provide term loans, line of credit, financing for invoices, and more.

Be the first place your customers turn for all their capital needs.

Insights

and retention

Find new ways to boost customer loyalty

and be a trusted financial partner.

Gain insight into your financing program.

Use data to better target active customers.

Pinpoint key upsell opportunities.

Compliance

and

risk management

Reap all the reward without

taking on any of the risk.

Leave all regulatory compliance to us.

Avoid the complexities of offering a commercial lending product.

Stay in control of the financial products being offered to your customers.

Key features

Simple, easy and quick

API integration

Out-of-the-box product

marketing support

Tailored financing options and progressive credit limits

Fully-secure KYC, KYB, AML, and

regulatory compliance

Loans funded in as little as 24 hours

Hands-free servicing and collections

Get the answers

you need

Kanmon is operated by Kanmon Inc. Kanmon Inc makes capital available to businesses through business loans, lines of credit, and advances. California loans are made pursuant to Kanmon’s California Department of Financial Protection and Innovation (DFPI) Finance Lenders Law License #60DBO-144925. Kanmon does not currently meet the applicability thresholds for the California Consumer Privacy Act. As set forth in our Privacy Policy and with respect of California residents, Kanmon will not share information we collect about you with affiliated or non-affiliated third parties, except in the limited circumstances disclosed in our Privacy Policy and permitted under California law, or if you give us permission. To learn more, please contact hello@kanmon.com.